The recently announced trade agreement between the United States and Japan marks a pivotal moment in international economic relations. Under this new framework, tariffs on Japanese goods entering the U.S.

Did You Know

Sea otters hold hands while sleeping to avoid drifting apart in the water.

?

AD

will be reduced to 15%, significantly less than the previously threatened 25%. This deal not only alleviates concerns over rising tariffs but also ushers in a profound commitment from Japan to invest $550 billion into the American economy, promising a renewed era of cooperation between these two formidable trading partners.

However, the automotive sector stands at the center of this unfolding story. U.S. automakers have expressed apprehension regarding their competitiveness under this agreement, fearing that fiscal burdens created by increased import taxes on essential materials like steel and aluminum could inhibit growth. American companies like General Motors and Ford have seen mixed responses in the stock market, showcasing the fragile balance between investor optimism and industry trepidation. This dynamic places added pressure on industry leaders to navigate a path that upholds both American jobs and economic vitality.

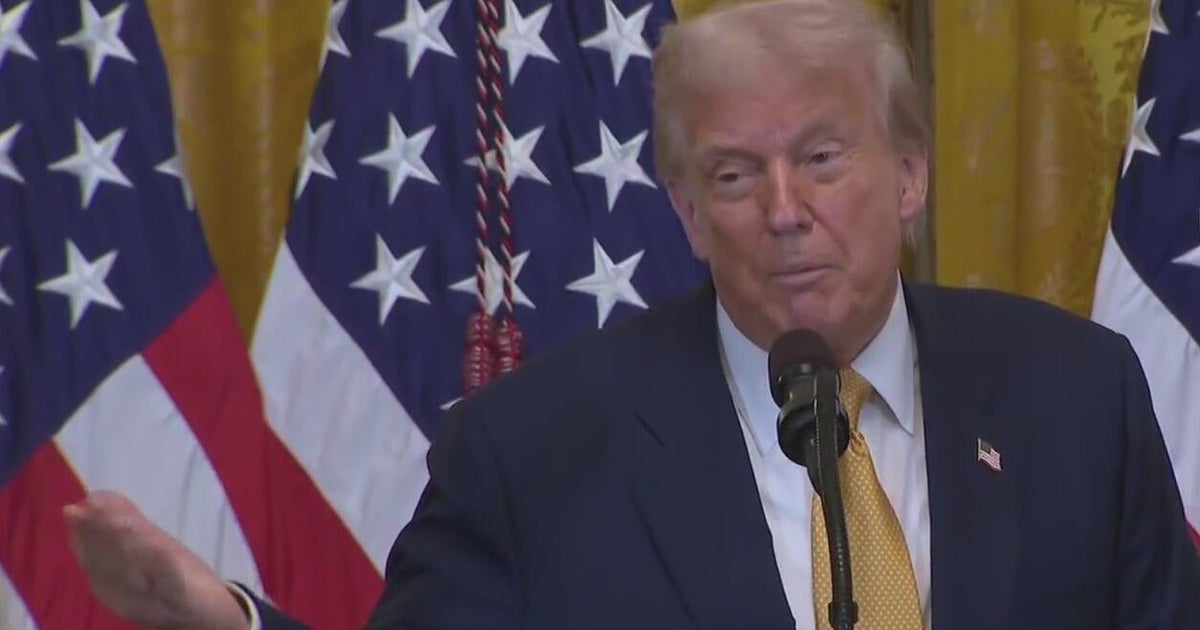

While the trade deal is being hailed as a political triumph for President Trump and Japanese Prime Minister Shigeru Ishiba, it carries broader implications for global trade dynamics. Investors worldwide have reacted positively, driven by optimism for potential agreements with other regions, including the European Union. Yet, as economic uncertainties linger, stakeholders remain vigilant about the long-term consequences of this arrangement. The deal exemplifies a commitment to navigating tumultuous trade waters, yet it also raises fundamental questions about the future of international commerce and its intricate balancing act between cooperation and competition.

Q&A (Auto-generated by AI)

What are the key points of the US-Japan trade deal?

The US-Japan trade deal primarily involves a reciprocal tariff rate of 15% on Japanese goods entering the United States, reduced from a previously threatened 25%. It aims to enhance trade relations between the two nations, with Japan committing to invest $550 billion in the US economy. The agreement is expected to boost Japanese exports, particularly in the automotive sector, while providing American consumers with more access to Japanese products at lower prices.

How do tariffs impact international trade?

Tariffs are taxes imposed on imported goods, which can raise the cost for consumers and affect trade dynamics. They can protect domestic industries by making foreign products more expensive, but excessive tariffs may lead to trade wars, reducing overall trade volumes. In the case of the US-Japan deal, the reduction of tariffs aims to foster a more favorable trade environment, encouraging economic cooperation and potentially increasing market access for both countries.

What is the historical context of US-Japan relations?

US-Japan relations have evolved significantly since World War II, transitioning from adversaries to strong economic partners. The 1960s saw the signing of a mutual security treaty, while the 1980s brought trade tensions over automotive exports. The recent trade deal reflects ongoing efforts to balance trade relations, with Japan being a key ally in Asia. The historical context underscores a complex relationship shaped by economic interdependence and geopolitical strategy.

How might this deal affect US automakers?

US automakers express concern that the new 15% tariff on Japanese vehicles may disadvantage them, as they face higher import taxes on steel and parts compared to their Japanese counterparts. This could hinder their competitiveness in the global market. While the deal aims to lower tariffs, US companies worry that it might not sufficiently address the structural challenges they face against Japanese manufacturers, potentially impacting their market share.

What are the implications for global markets?

The US-Japan trade deal is expected to have positive implications for global markets, as it signals a potential easing of trade tensions. Investors often react favorably to such agreements, anticipating increased trade flows and economic stability. The deal may also set a precedent for future agreements, influencing negotiations with other countries, including the European Union. Overall, it could foster a more interconnected global economy.