In a significant move set to reshape the financial landscape, Bank of America is poised to launch its own stablecoin, as CEO Brian Moynihan highlights the bank's commitment to this innovative digital currency.

Did You Know

A day on Venus is longer than a year.

?

AD

This initiative aligns with a broader trend among major U.S. lenders, including Citibank, eagerly anticipating the adoption of crypto-friendly regulations. As traditional financial institutions adapt to the digital age, the concept of stablecoins—designed to maintain a stable value—has gained traction among industry leaders who recognize their potential to drive mainstream adoption.

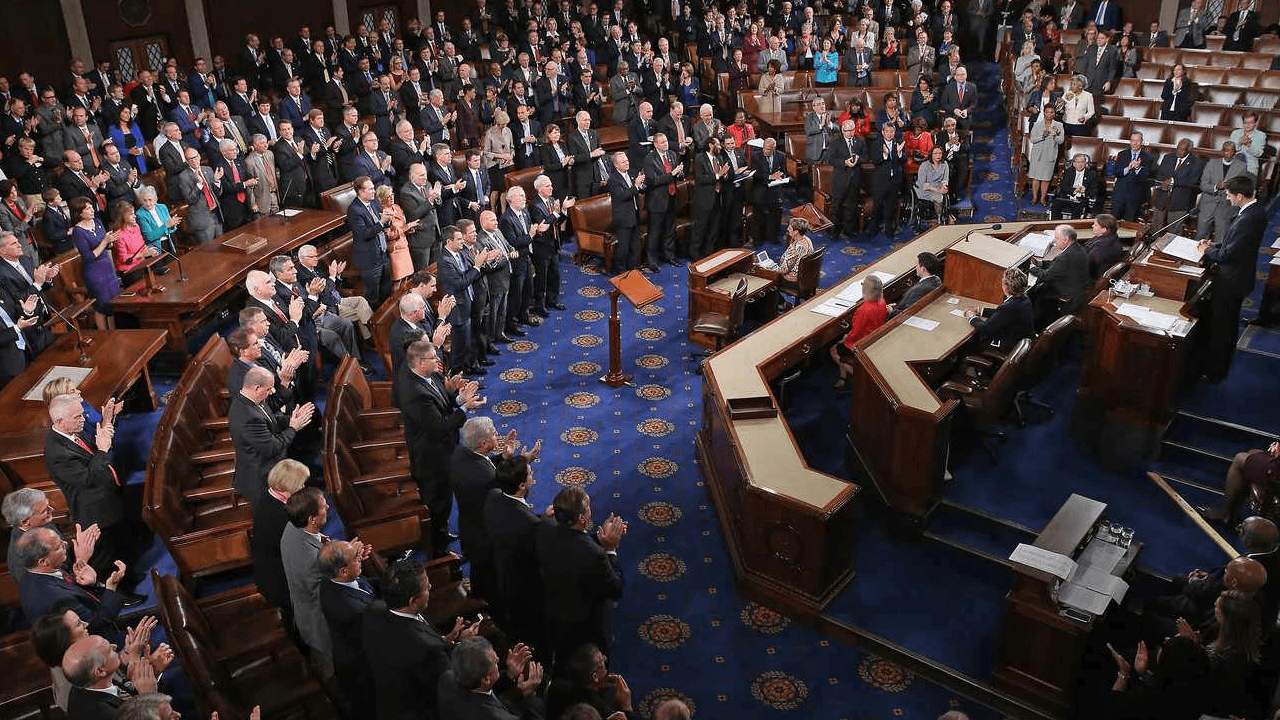

At the heart of this burgeoning cryptocurrency narrative is the GENIUS Act, a legislative proposal supported by President Donald Trump. The Act aims to create a robust regulatory framework for stablecoins, providing needed clarity and legitimacy to the growing market. Following a recent vote in the U.S. House to advance the GENIUS Act, proponents are expressing optimism that these regulations will accelerate the integration of stablecoins into everyday financial transactions, fundamentally transforming how individuals and businesses manage their finances.

As the dialogue around stablecoins intensifies, the ripple effects are already being felt in the markets, with cryptocurrencies experiencing notable surges in value following the renewed legislative focus. Investors are increasingly optimistic about the viability of digital currencies, particularly as financial institutions and government officials converge on a unified approach to crypto regulation. This intersection of banking and governance signifies a turning point for stablecoins, as they prepare to embrace a future that could elevate them into the mainstream of global finance.

Q&A (Auto-generated by AI)

What is the GENIUS Act about?

The GENIUS Act, or Guiding and Establishing National Innovation for U.S. Stablecoins, aims to create a regulatory framework for stablecoins. This legislation seeks to clarify the legal status of stablecoins, which are digital assets pegged to traditional currencies or commodities, ensuring they can be used safely in electronic payments. By providing a structured approach, the act aims to promote innovation in the cryptocurrency space while addressing regulatory concerns.

How do stablecoins function?

Stablecoins are cryptocurrencies designed to maintain a stable value by pegging their worth to a reserve of assets, such as fiat currencies or commodities. This pegging mechanism helps mitigate the volatility often associated with traditional cryptocurrencies like Bitcoin. For example, a stablecoin might be backed 1:1 by the U.S. dollar, allowing users to transact with confidence that their digital currency will not fluctuate wildly in value.

Why are banks interested in stablecoins?

Banks are increasingly interested in stablecoins as they provide a way to engage with the growing digital asset market while maintaining regulatory compliance. By launching their own stablecoins, banks like Bank of America and Citibank can leverage blockchain technology for faster transactions and lower costs. Additionally, stablecoins can enhance the efficiency of payment systems and offer customers more options in a digital economy.

What impact could GENIUS have on crypto?

The GENIUS Act could significantly impact the cryptocurrency landscape by establishing clear regulations for stablecoins, potentially leading to increased adoption and mainstream use. By legitimizing stablecoins, the act may encourage more financial institutions to participate in the crypto space, fostering innovation and competition. This regulatory clarity could also enhance consumer protection and trust in digital assets, driving broader acceptance.

How does Congress influence cryptocurrency laws?

Congress influences cryptocurrency laws through legislation that sets the regulatory framework for digital assets. By proposing and voting on bills like the GENIUS Act, lawmakers can define how cryptocurrencies are classified, taxed, and regulated. This legislative process shapes the operational landscape for businesses and consumers, impacting everything from compliance requirements to innovation in the fintech sector.