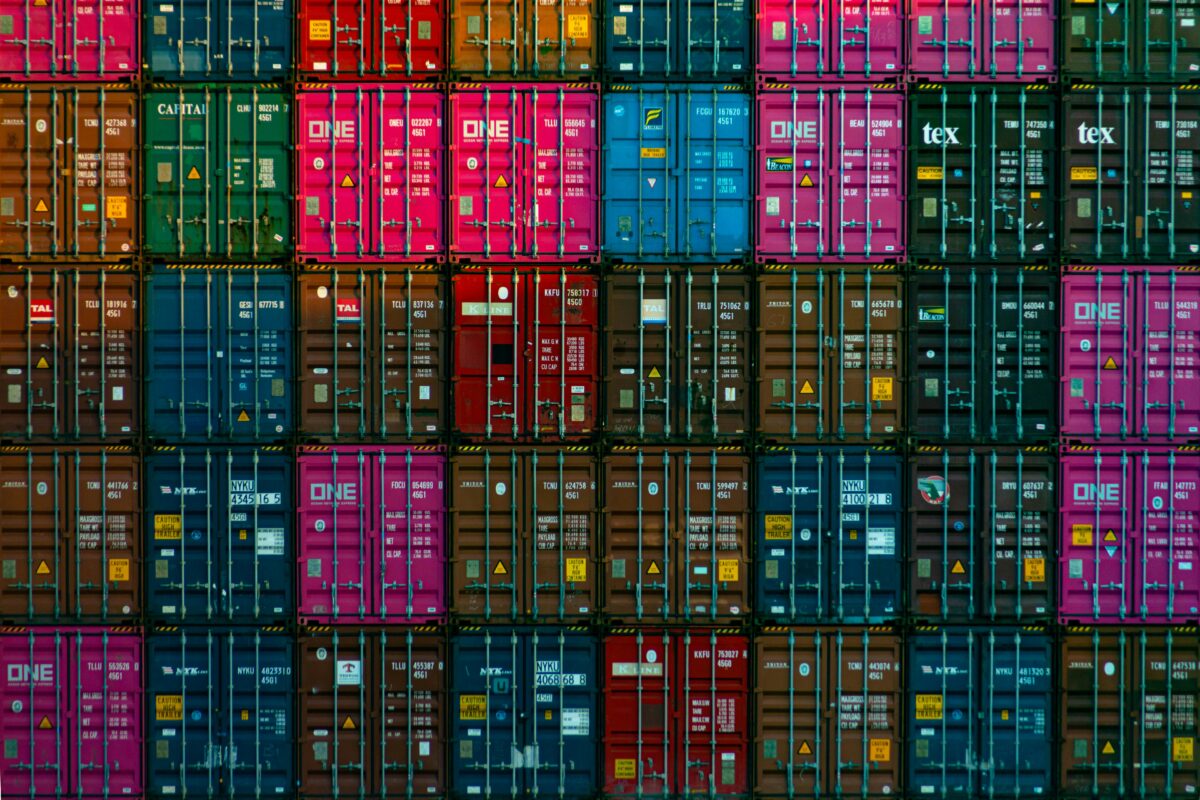

The U.S. Department of Commerce has announced a robust response to dumping practices, proposing a staggering 93.5% antidumping tariff on graphite imports from China. This decision marks a critical move

Did You Know

Butterflies taste with their feet.

?

AD

in the ongoing battle to protect American industries, particularly in the thriving sectors of battery production and renewable energy. Companies like Novonix have praised this initiative, viewing it as essential to maintaining a level playing field for domestic manufacturers while also reflecting a broader strategy to invigorate U.S. manufacturing jobs.

Simultaneously, U.S. solar manufacturers are rallying for similar protections, filing petitions that target imports from Indonesia, India, and Laos. These producers contend that unfair pricing practices by foreign competitors jeopardize the viability of domestic factories and hinder the growth of the American solar industry. By seeking antidumping and countervailing duties, U.S. manufacturers hope to level the competitive landscape and ensure that solar technology is produced on American soil, rather than relying on subsidized imports.

These developments underscore a significant shift in U.S. trade policy, as protectionist measures gain traction against a backdrop of rising economic nationalism. The imposition of such tariffs signifies Washington’s commitment to preserving American jobs and fostering domestic innovation in key sectors. As trade tensions escalate, the battle over materials essential to the future of renewable energy takes center stage, illustrating the high stakes involved in global commerce and the urgent need for a robust, resilient manufacturing base in the United States.

Q&A (Auto-generated by AI)

What are antidumping tariffs?

Antidumping tariffs are duties imposed by a government on foreign imports that it believes are priced below fair market value, often due to subsidies or unfair pricing practices. These tariffs aim to protect domestic industries from unfair competition and allow local manufacturers to compete more effectively. For example, U.S. solar panel manufacturers are seeking such tariffs against imports from Indonesia, India, and Laos to counteract low-priced goods that undercut U.S. production.

How do tariffs affect solar panel prices?

Tariffs on solar panel imports can lead to higher prices for consumers and businesses in the U.S. by increasing the cost of imported goods. When tariffs are imposed, domestic manufacturers may also raise their prices due to reduced competition. This can ultimately slow the adoption of solar energy technologies, which rely on affordable components. However, tariffs may encourage domestic production, potentially leading to job creation in the U.S. solar industry.

What is the impact of dumping on markets?

Dumping can severely disrupt local markets by flooding them with low-priced goods, making it difficult for domestic producers to compete. This can lead to reduced sales, lower profits, and potential layoffs in local industries. In the case of U.S. solar panel manufacturers, imports from countries accused of dumping can undermine new factories and investments in the U.S., prompting calls for protective measures like antidumping tariffs.

Why target imports from Indonesia and India?

Imports from Indonesia and India are targeted due to allegations of these countries dumping solar panels at prices below fair market value. This practice can undermine U.S. manufacturers, making it challenging for them to establish a competitive foothold in the market. By imposing tariffs, the U.S. aims to level the playing field and support its domestic solar manufacturing sector, which is crucial for energy independence and job creation.

What role does the US Department of Commerce play?

The U.S. Department of Commerce is responsible for investigating claims of unfair trade practices, including dumping. It assesses petitions from domestic industries seeking relief through tariffs. In the case of solar panel imports, the Department plays a critical role in determining whether to impose antidumping and countervailing duties based on evidence of pricing practices that harm U.S. manufacturers.