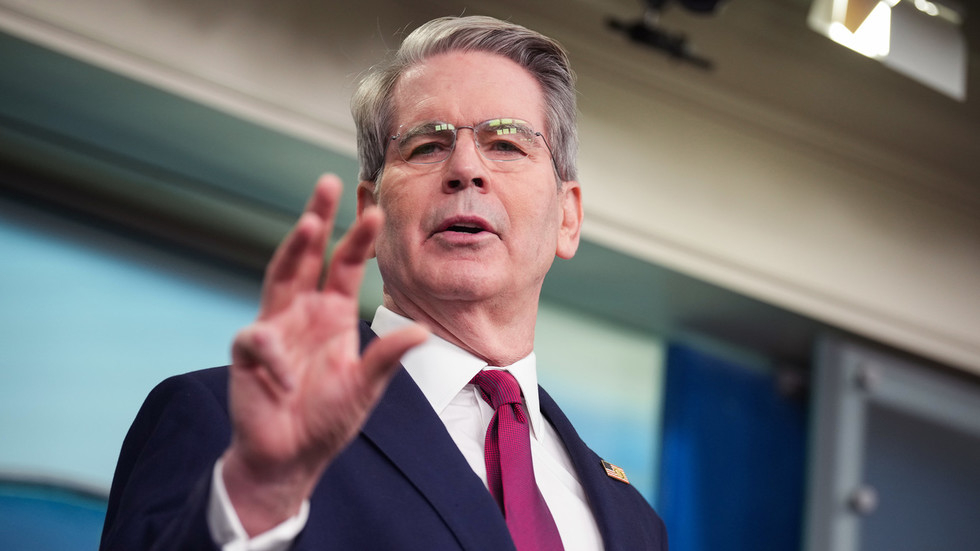

In a striking move that has rattled conventional economic discourse, U.S. Treasury Secretary Scott Bessent, an ally of President Trump, has called for a comprehensive review of the Federal Reserve. His

Did You Know

The average person spends six months of their life waiting for red lights to turn green.

?

AD

remarks suggest the need for a critical examination of the institution’s effectiveness and overall function, going beyond current controversies like building renovations. By questioning whether the Fed has truly fulfilled its mission, Bessent is setting the stage for a potential shift in how monetary policy is approached in the current administration.

Bessent has publicly criticized the Federal Reserve for its historical actions, particularly its stance on Trump’s tariff policies, suggesting that those decisions may have held back the U.S. economy. He believes the economy could be on the cusp of significant growth, comparable to the late 1990s dot-com boom, asserting that the Fed’s current policies might obstruct this potential advancement.

The tension between the Trump administration and the Federal Reserve, especially with Chairman Jerome Powell, is palpable. While reports indicated that Bessent advised Trump against firing Powell, the President has denied these claims, fueling speculation about internal conflicts. Additionally, Bessent provocatively likens the Fed’s role to “universal basic income for academic economists,” asserting that it may be time for profound reform. As Bessent champions the need for systemic change, the future direction of the Federal Reserve and its impact on the economy hangs in the balance.

Q&A (Auto-generated by AI)

What are the Fed's main responsibilities?

The Federal Reserve, or the Fed, serves as the central bank of the United States. Its main responsibilities include conducting monetary policy to manage inflation and stabilize the economy, supervising and regulating banking institutions to ensure financial system safety, and maintaining financial stability. The Fed also provides financial services to the government and financial institutions, including managing the country's money supply and serving as a lender of last resort during financial crises.

How has the Fed evolved over time?

Established in 1913, the Federal Reserve has undergone significant changes in response to economic challenges. Initially created to address banking panics, it expanded its role during the Great Depression and the 2008 financial crisis, adopting new tools like quantitative easing. The Fed's focus has shifted from simply managing the money supply to considering broader economic indicators, including employment and inflation, reflecting its dual mandate of promoting maximum employment and stable prices.

What criticisms has the Fed faced historically?

Historically, the Fed has faced criticism for its perceived lack of transparency and accountability, particularly during economic downturns. Critics argue that its policies can exacerbate economic inequality or lead to asset bubbles. For instance, during the 2008 financial crisis, the Fed was criticized for its role in low interest rates that some believe contributed to the housing bubble. More recently, Treasury Secretary Scott Bessent has called for a review of the Fed, questioning its effectiveness in fulfilling its mandates.

What impact do Fed policies have on the economy?

Federal Reserve policies significantly impact the economy by influencing interest rates, which affect borrowing and spending. For example, lowering interest rates can stimulate economic growth by making loans cheaper, encouraging consumer spending and business investment. Conversely, raising rates can help control inflation but may slow down economic activity. The Fed's decisions on monetary policy can also affect currency strength, employment rates, and overall economic stability.

How does the Treasury Secretary influence the Fed?

The Treasury Secretary plays a crucial role in shaping economic policy and can influence the Federal Reserve indirectly. While the Fed operates independently, the Treasury Secretary can advocate for specific monetary policies, especially during economic crises. For instance, Scott Bessent, as Treasury Secretary, has publicly called for a review of the Fed's operations, reflecting the administration's stance on economic management. This relationship can lead to discussions on fiscal and monetary policies that align with national economic goals.