While both stocks are cheap by valuation, the move will yield a bigger benefit for PFC shareholders, according to a Bernstein analyst.

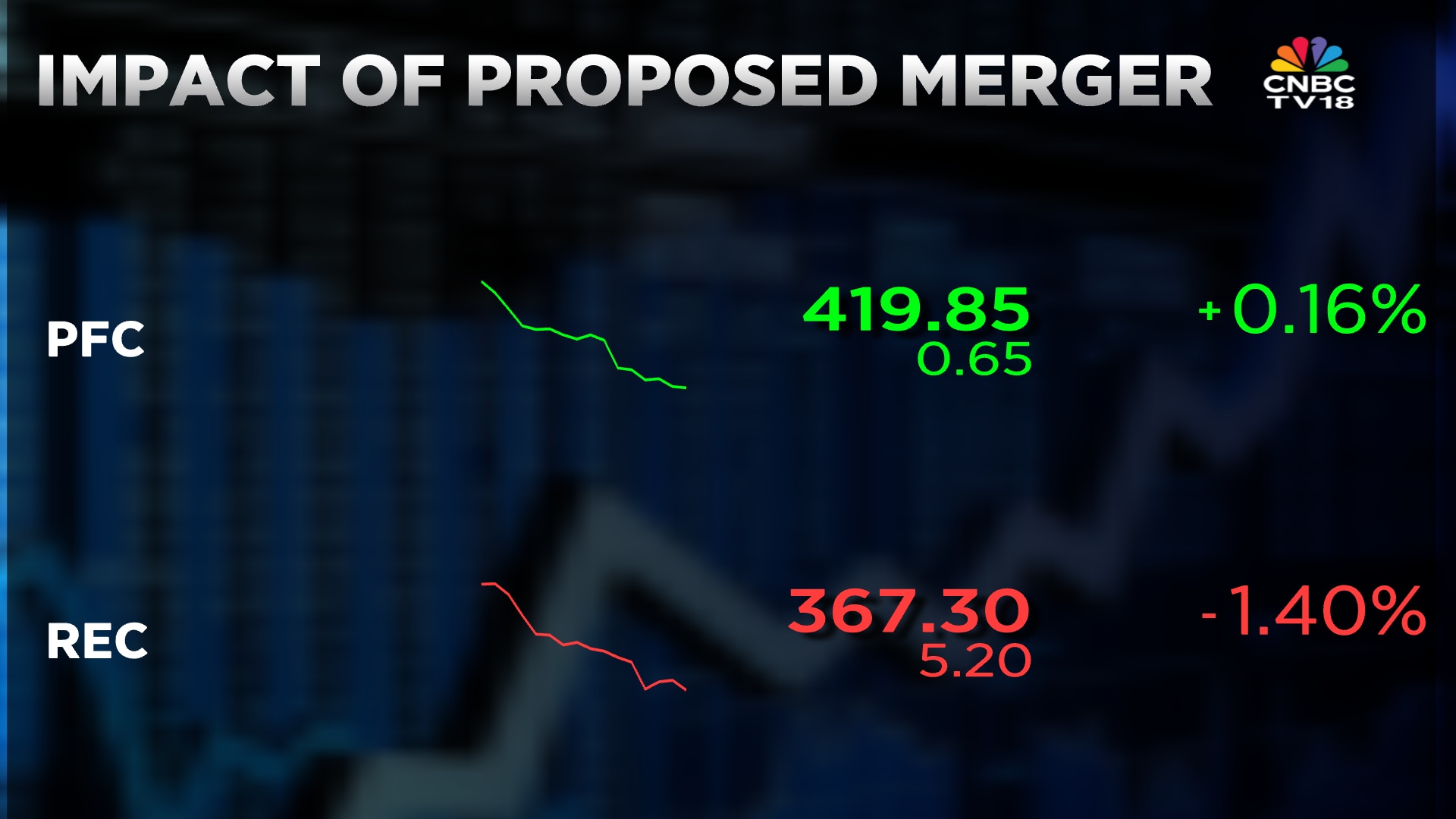

Share prices as at 9:30 am on Feb 9.

PFC already owns 52.6% stake in REC. Considering the share swap at the current market prices of PFC to acquire the remaining stake in REC, the Centre's holding in PFC will fall to 42% from the current 56%.

While more details of the proposed merger process is awaited, Emkay Global, a Mumbai-based broking firm, charted three possible ways this merger :

- A large-scale 'buyback' by PFC and REC, with the promoters not participating

- A large-scale (₹35,000 crore at current price) capital infusion by the Centre in PFC via preferential issuance

- Amending The Companies Act, 2013, as envisaged in the Economic Survey 2025-26, to allow the Centre's stake to increase 26% in a 'government company'.

A re-rating of the merged entity will be contingent on capacity expansion by coal-run power utilities (largely owned by state governments).

Put together, the two companies have a loan book of over ₹11 lakh crore.

In the second quarter, PFC's consolidated loan book had increased 10%, in the first quarter it was up 12.9% and in the preceding quarter it had increased 12%.

Also Read: Kotak Mahindra Bank shares in focus after it clarifies on IDBI Bank bid