The Deceptive Lure

A businessman in Pune, aged 48, found himself ensnared in a sophisticated online investment scam, resulting in a devastating financial loss of ₹1.15 crore.

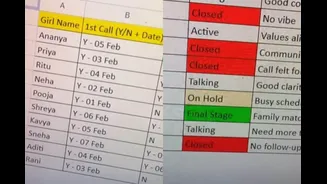

The deception began subtly, with the victim being invited into a WhatsApp group. Within this group, individuals presented themselves as seasoned share market trading experts, promising regular training sessions and showcasing impressive profits through shared screenshots. This carefully crafted illusion of easy wealth was designed to build trust and encourage participation. As the victim became increasingly intrigued, he was persuaded to divulge his financial information and download a specific share trading application. This application, unbeknownst to him, was a tool of manipulation, allowing the fraudsters to funnel his invested funds into illicit 'mule accounts' rather than legitimate market investments. The platform itself was programmed to display artificially inflated 'returns,' creating a mirterage of immense profitability that fueled the victim's desire to invest even more capital, deepening his entanglement in the fraudulent scheme over a period of approximately five weeks.

Escalating Losses

The fraudulent application continued to feed the victim a steady stream of fabricated gains, depicting profits that were often multiples of his actual invested sums. This digital fantasy lured him into making successive deposits, believing he was on the cusp of significant financial success. The fraudsters expertly played on his aspirations, encouraging him to transfer more and more money into the platform. However, when the businessman eventually decided it was time to reap his supposed rewards and requested to withdraw his funds, he was met with another hurdle. The scammers demanded a substantial sum, presented as 'tax' and 'processing fees,' before any funds could be released. It was at this point, after a series of increasingly large transactions and the demand for further payment, that the harsh reality of the situation began to dawn on him. He had transferred a colossal amount of ₹1.15 crore in multiple substantial transactions, only to realize that he had been unequivocally defrauded. Recognizing the gravity of the situation, he promptly sought the assistance of the Cyber Crime Police Station, accompanied by his son, to report the elaborate scam and initiate the process of seeking recourse.

A Growing Epidemic

This incident is not an isolated case but rather a chilling indicator of a pervasive and escalating problem within Pune and the Pimpri-Chinchwad region. Cyber investigators have labelled the surge in online share trading fraud cases an 'epidemic,' highlighting a disturbing trend that has persisted for over two and a half years. The perpetrators employ a diverse array of deceptive strategies, including providing spurious trading tips, conducting fictitious virtual lectures, promoting fraudulent mobile applications, and making alluring promises of exorbitant investment returns. Authorities have voiced significant concern regarding the continued vulnerability of citizens to these scams. Despite persistent advisories, widespread awareness campaigns, and extensive media coverage aimed at educating the public, individuals continue to fall prey to these sophisticated ploys, underscoring the persistent challenge in combating cybercrime. The sheer volume and consistent nature of these reports underscore the urgent need for heightened vigilance and more robust preventive measures.

Regulatory Warnings

The Securities and Exchange Board of India (SEBI) has previously issued stern warnings regarding these fraudulent schemes, as detailed in an advisory released last year. Fraudsters are actively luring potential victims by offering seemingly legitimate online trading courses, seminars, and mentorship programs. They leverage popular social media platforms such as WhatsApp and Telegram, and even conduct live broadcasts to reach a wider audience. A particularly insidious tactic involves these individuals posing as employees or affiliates of SEBI-registered Foreign Portfolio Investors. They then pressure individuals into downloading custom applications that deceptively appear to enable share purchases, IPO subscriptions, and access to 'Institutional account benefits' without requiring the establishment of a formal trading or Demat account. To further obscure their identities and evade detection, these operations frequently utilize mobile numbers registered under fabricated identities, orchestrating their criminal enterprises with a high degree of anonymity and sophistication.