The Deceptive WhatsApp Group

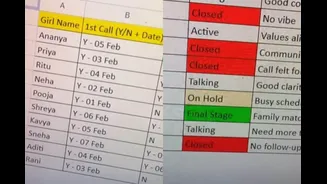

A 48-year-old entrepreneur from Pune, who runs a laundry business, recently experienced a devastating financial loss amounting to ₹1.15 crore. The incident

began when he was added to a WhatsApp group that promised exclusive training sessions focused on share market trading. Within this online community, other participants frequently showcased fabricated screenshots depicting significant profits from their investments, creating an illusion of legitimate success and encouraging new members to participate. This carefully orchestrated environment was designed to build trust and entice victims into the fraudsters' trap. Following this initial engagement, the businessman was prompted to share sensitive personal financial information and subsequently download a specialized stock trading application. This application served as the primary vehicle for the fraudulent activities, creating a false sense of opportunity and security for the unsuspecting investor, laying the groundwork for the subsequent financial drain.

Fake App, Real Losses

Once the businessman had downloaded the fraudulent trading application and shared his financial details, the cybercriminals, masquerading as seasoned share market experts, started providing him with investment advice. These tips were channeled through the compromised application, which was programmed to display fabricated returns on his investments, often portraying gains that were multiple times the actual amount invested. This tactic was highly effective in luring the victim to transfer increasingly larger sums of money, as the app consistently showed escalating fictitious profits. Over a period of approximately five weeks, he made numerous transactions, each adding to the illusion of wealth accumulation. The application's interface was meticulously designed to mimic a legitimate trading platform, complete with charts and performance indicators, reinforcing the victim's belief in the legitimacy of his supposed earnings and motivating him to invest more capital, unaware that the funds were being siphoned into untraceable mule accounts.

The Withdrawal Trap

The elaborate scam reached its climax when the businessman, convinced by the apparent profits shown in the fake application, decided to withdraw his funds. At this critical juncture, the fraudsters introduced a new layer of deception, demanding a substantial amount to be paid as taxes and processing fees before any withdrawal could be facilitated. By this point, the victim had already transferred a staggering ₹1.15 crore through a series of large transactions. Upon realizing that he had been the victim of a sophisticated fraud, he, accompanied by his son, approached the Cyber Crime Police Station. Following their complaint, a First Information Report (FIR) was officially registered, marking the beginning of the investigative process into this significant financial crime that has become an alarming trend in the region, with authorities working to combat the persistent rise in such online investment frauds.

Pune's Growing Scam Epidemic

The incident involving the laundry businessman is sadly not an isolated case; it highlights a concerning and escalating trend of online share trading fraud that has been plaguing Pune and Pimpri Chinchwad for over two and a half years. Cyber investigators have described this as an 'epidemic' due to the persistent and worrying surge in such cases. The modus operandi employed by these fraudsters is varied, encompassing the provision of trading tips, conducting virtual lectures, utilizing sophisticated mobile applications, and promising incredibly high and unrealistic returns on investments. Despite repeated public advisories, widespread sensitisation campaigns, and extensive media coverage detailing these scams, law enforcement officials express dismay that a significant number of citizens continue to fall prey to these deceptive schemes, underscoring the need for increased vigilance and awareness among the public regarding digital financial security.