By Yousef Saba and Luke Tyson

DUBAI (Reuters) -Saudi Arabian oil company Aramco reported a 22% drop in second-quarter profit on Tuesday, and the world's top oil exporter said it was cutting costs and looking

to divest assets as crude prices drop and its debt mounts.

The firm's generous dividends, a key source of funding for ambitious plans to cut the kingdom's reliance on oil, will be about a third lower this year

Aramco reported its 10th decline in quarterly net profit to $22.7 billion in the three months ended June 30, from $29.1 billion a year earlier.

Adjusted net income fell 13.7% to $24.5 billion, above a company-provided median analyst estimate of $23.7 billion.

"What we're looking at across the portfolio is to unlock capital that is currently locked into low - relatively low-return (assets) ... invest it in our core investment, which are high return," CFO Ziad Al-Murshed told reporters.

He declined to name the assets, but said: "it is your typical low-return that is tied in things like infrastructure."

Reuters reported last month that Aramco was close to a deal to raise $10 billion from a group led by BlackRock, and is considering selling up to five gas-powered power plants to raise up to $4 billion.

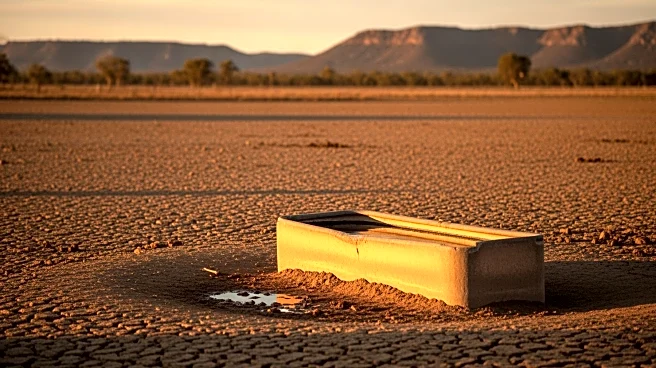

Aramco's average realised crude oil price was $66.7 a barrel in the quarter, down from $85.7 in the second quarter of 2024 and $76.3 in the first quarter of this year.

Total borrowing rose to $92.9 billion at June 30 from $74.4 a year prior. Gearing, a measure of indebtedness, rose to 6.5% from minus 0.3% a year earlier and 5.3% the previous quarter.

The company, long a reliable source of revenue for the Saudi state, confirmed a previously outlined $21.3 billion in total dividends for the second quarter, about $200 million of which is performance-linked dividends.

DIVIDENDS SINK

Aramco in March outlined total dividends of $85.4 billion for 2025 - a 31% drop from more than $124 billion the previous year. The performance-linked component is set to plunge 98% from 2024 to $900 million as the company's free cash flow dwindles.

Free cash flow dropped nearly a fifth year-on-year in the second quarter to $15.2 billion.

For the Saudi government, which owns 81.5% of Aramco shares directly and another 16% through its sovereign wealth fund PIF, dividends are a critical source of income, particularly as it invests to diversify the economy away from oil.

Oil generated 62% of the government's revenue last year. The International Monetary fund estimates the kingdom needs oil prices at more than $90 a barrel to balance its 2025 budget.

Global crude benchmark Brent was trading at $68.83 on Tuesday.

"We've pencilled in for Saudi Arabia to run a budget deficit of 5.0% of GDP this year," said James Swanston, senior economist at Capital Economics, adding the government would likely overshoot its annual borrowing plan.

That would be more than double the 2.3%, or about $27 billion, deficit the kingdom projected in November for the 2025 budget.

(Reporting by Yousef Saba and Luke Tyson in Dubai; Editing by Mark Potter and Bernadette Baum)