What's Happening?

Private equity deals reached unprecedented levels in 2021, with a total value exceeding $1 trillion and average deal sizes surpassing $1 billion. During this period, tech companies like Klarna and Stripe saw soaring valuations, becoming media favorites. However, by 2023, these companies experienced significant declines in value, with Klarna's valuation dropping by 85% and Stripe's by nearly half. Despite these setbacks, investors continue to pour money into high-risk ventures, particularly in the AI sector. The phenomenon is likened to the 'Hot Crazy Matrix,' a meme that humorously categorizes investment behavior based on expertise and risk-taking. Investors are often swayed by personalities and promises rather than scrutinizing product value and market fit, leading to costly missteps.

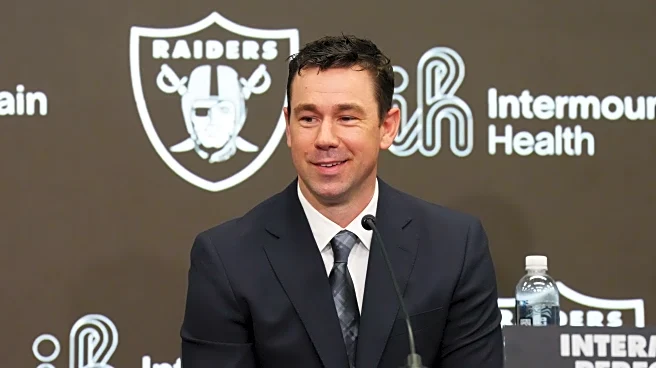

AD

Why It's Important?

The ongoing trend of investing in tech startups without thorough evaluation poses risks to the financial sector and the broader economy. As investors chase the latest trends, they may overlook fundamental business metrics, leading to potential losses and market instability. This behavior can impact the tech industry by inflating valuations and creating unsustainable business models. The pressure on dealmakers to invest large sums without adequate scrutiny can result in financial mismanagement and reduced investor confidence. The lesson from the 'Hot Crazy Matrix' is that successful investments require a balance of expertise and commercial insight, emphasizing the need for discernment over enthusiasm.

What's Next?

Investors and private equity firms may need to reassess their strategies, focusing on deeper understanding and evaluation of potential investments. As the tech industry continues to evolve, there may be increased emphasis on niche expertise and sustainable business practices. Stakeholders, including tech companies and investors, might seek to establish more rigorous standards for evaluating startups, potentially leading to a shift in investment patterns. The industry could see a move towards more cautious and informed investment decisions, prioritizing long-term value over short-term gains.

Beyond the Headlines

The implications of this investment behavior extend beyond financial losses. It highlights ethical considerations in investment practices, such as the responsibility of investors to conduct thorough due diligence. The trend also underscores cultural shifts in the tech industry, where flashy presentations and high valuations can overshadow genuine innovation and value creation. Long-term, this could lead to a reevaluation of how success is measured in the tech sector, potentially fostering a more sustainable and ethical investment environment.