Rapid Read • 8 min read

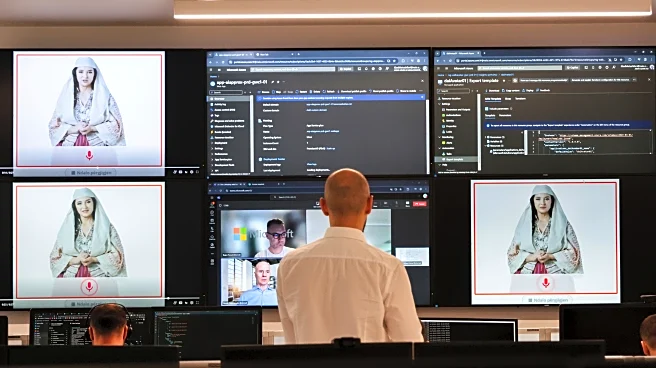

Presidio Petroleum has announced its plans to become a publicly listed company through a strategic merger with EQV Ventures Acquisition Corp. The merger will result in the formation of Presidio Production Company, which will operate over 2,000 producing wells across Texas, Oklahoma, and Kansas. The combined entity is expected to have a post-transaction enterprise value of approximately $660 million. Presidio's management team, including Co-CEOs Will Ulrich and Chris Hammack, will lead the new company. The merger includes the acquisition of a Texas Panhandle asset from EQV Resources LLC, an affiliate of EQV Ventures. Presidio aims to optimize its acquisitions using technology such as automation, real-time data analytics, and AI processes.

AD

This merger marks a significant development in the energy sector, particularly as the industry shifts from capital-intensive shale operations to a focus on returns. Presidio's approach, which emphasizes acquiring under-managed oil and gas wells and optimizing them, presents a contrarian strategy that could yield substantial free cash flow. The company's entry into the public markets is poised to attract investors looking for yield-driven models with minimal reliance on future drilling. Presidio's strategy could set a precedent for other companies in the sector, highlighting the importance of technology and efficiency in asset management.

Following the merger, Presidio will focus on scaling its yield-focused model and pursuing further acquisitions. The company aims to become a leading consolidator of mature oil and gas assets, leveraging its expertise and capital discipline to enhance efficiency and returns. The listing on the NYSE under the ticker 'FTW' will provide Presidio with a platform to attract investment and expand its operations. Stakeholders, including investors and industry leaders, will be watching closely to see how Presidio's strategy unfolds in the public market.

Presidio's merger and public listing could have broader implications for the energy sector, particularly in terms of how companies manage mature assets. The focus on technology-driven optimization may influence industry standards and practices, encouraging other companies to adopt similar strategies. Additionally, Presidio's emphasis on capital discipline and efficiency could impact how investors evaluate oil and gas companies, potentially shifting investment priorities within the sector.

AD

More Stories You Might Enjoy